In early 1944, journalist Arthur Koestler was onto the horrors of the Holocaust taking place in Europe. He wrote this essay, originally published in the New York Times, calling attention to the atrocities in a climate where most in media were denying or claiming conspiracy.

At present we have the mania of trying to tell you about the killing, by hot steam, mass-electrocution and live burial of the total Jewish population of Europe. So far three million have died. It is the greatest mass-killing in recorded history; and it goes on daily, hourly, as regularly as the ticking of your watch.

We say, “I believe this,” or, “I don’t believe that,” “I know it,” or “I don’t know it”; and regard these as black-and-white alternatives. Now in reality both “knowing” and “believing” have varying degrees of intensity. I know that there was a man called Spartacus who led the Roman slaves into revolt; but my belief in his one-time existence is much paler than that of, say, Lenin. I believe in spiral nebulae, can see them in a telescope and express their distance in figures; but they have a lower degree of reality for me than the inkpot on my table.

Even during the war, the levels of denial were palpable. People didn’t believe the available evidence of what the Nazi regime was doing. He closes out the essay with a remarkably prescient observation of what happens when communications are pervasive: we have more evidence than ever before, and yet still have trouble separating fact and fantasy:

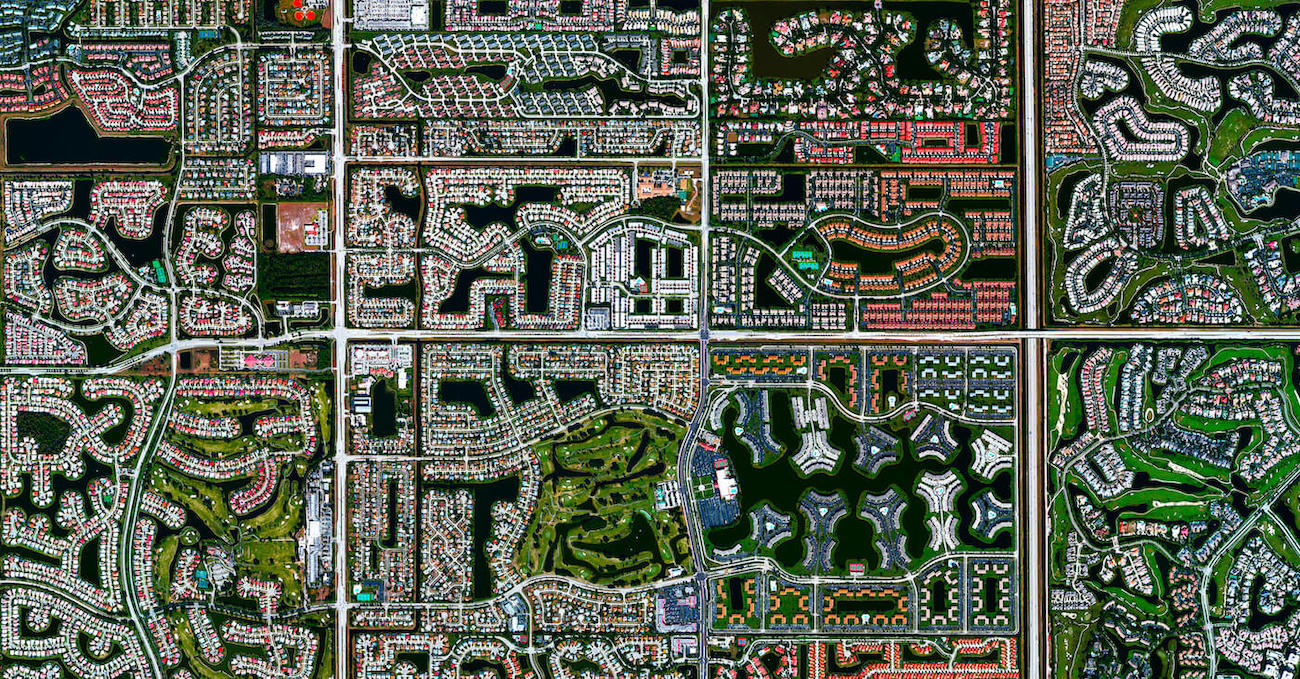

Our awareness seems to shrink in direct ratio as communications expand; the world is open to us as never before, and we walk about as prisoners, each in his private portable cage. And meanwhile the watch goes on ticking. What can the screamers do but go on screaming, until they get blue in the face?

See also episode #40 of The Portal, where Eric Weinstein discusses the essay.

Alex Crompton responds to the supply problem in investing in companies:

There are way more investors than there are companies that make investors money. By some estimates, less than 1% of the companies investors fund generate over 75% of the profits across the entire industry.

Since investors are always seeking the opportunities from the same supply of founders and companies, there are only a few tactics that can work to differentiate yourself and find the truly great returns — primarily access, exposure, and quality selecting (picking the winners from the group).

But at his firm EF, a unique sort of incubator, they focus on generating supply. If you can generate founders no one else is finding (because they’re otherwise never founding companies), you create a type of alchemy that spawns ideas that’d never get off the ground otherwise.

This is what we’re doing at EF. We are taking in raw materials — hundreds of extraordinary people from across the world every year — and putting them through an iterative, data driven methodology. We are experimenting all the time: collecting information about the founders we support; understanding their qualitative experience; and learning what works and doesn’t work. From the moment we first make contact, we are building a methodology to get them from Day minus 100 to Day 1 of something valuable.

Vitalik Buterin on the Gini coefficient’s problems when measuring distributions in crypto:

A typical resident of a geographic community spends most of their time and resources in that community, and so measured inequality in a geographic community reflects inequality in total resources available to people. But in an internet community, measured inequality can come from two sources: (i) inequality in total resources available to different participants, and (ii) inequality in level of interest in participating in the community.